Are you curious about how to start investing money and build wealth? Look no further! In “Investing Money: A Beginner’s Guide to Building Wealth,” we will explore the fundamental principles of investing and provide you with the knowledge and tools to kickstart your journey toward financial success. This comprehensive guide covers all the investing basics, making it perfect for those who are new to the world of investing. So, whether you’re looking to grow your savings or secure your financial future, this article is here to help you every step of the way.

Investing Money

Welcome to the world of investing! Whether you’re just starting your financial journey or looking to grow your wealth, understanding the basics of investing is a crucial step towards achieving your financial goals. In this comprehensive guide, we will cover everything you need to know to get started on your investment journey.

Understanding the Basics of Investing

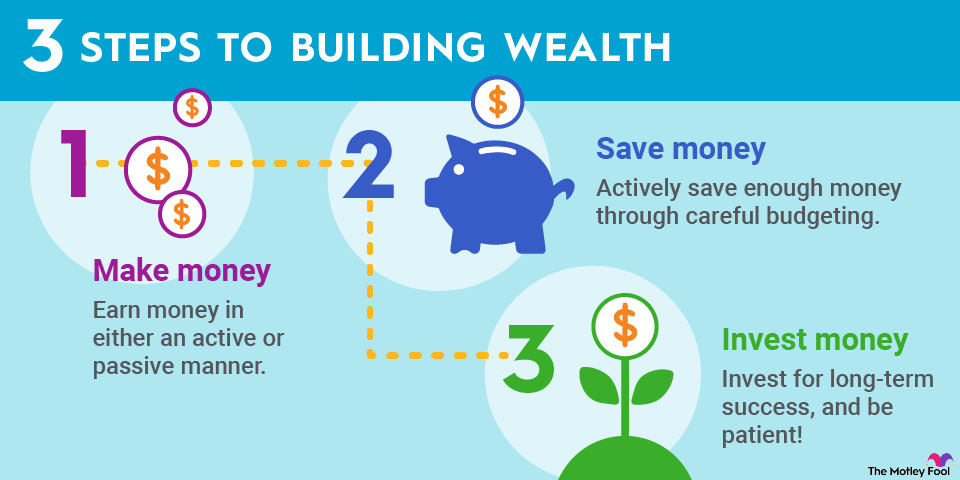

Investing is the process of putting your money into various assets with the expectation of earning a profit in the future. It involves taking calculated risks to potentially grow your wealth over time. By investing your money, you can make it work for you and generate passive income.

To embark on your investment journey, it’s important to familiarize yourself with the different types of investments available. Some common investment options include stocks, bonds, real estate, mutual funds, exchange-traded funds (ETFs), and index funds. Each investment option carries its own level of risk and potential return.

It’s also essential to understand basic investment terminologies, such as asset allocation, diversification, and portfolio rebalancing. These concepts play a crucial role in building a successful investment strategy.

Setting Financial Goals

Before diving into the world of investing, it’s crucial to establish clear financial goals. What do you want to achieve with your investments? Are you saving for retirement, a down payment on a house, or your child’s education? Setting specific, measurable, attainable, relevant, and time-bound (S.M.A.R.T.) goals will help you stay focused and determine the best investment strategy for your needs.

It’s helpful to categorize your financial goals into short-term, medium-term, and long-term objectives. Short-term goals can be achieved within one to three years, while medium-term goals may take three to ten years. Long-term goals, such as retirement planning, typically have time horizons of over ten years.

Tracking your progress and making adjustments along the way is essential. Life circumstances may change, and it’s important to periodically reassess your financial goals. By regularly reviewing and updating your goals, you can ensure your investment strategy remains aligned with your aspirations.

Building an Emergency Fund

Before diving headfirst into investing, it’s crucial to establish an emergency fund. An emergency fund is a pool of money set aside to cover unexpected expenses or income disruptions, such as medical emergencies or job loss. By having a financial safety net, you can avoid derailing your investment plans when unforeseen circumstances arise.

Determining the right amount for your emergency fund depends on your individual circumstances. Financial experts generally recommend saving three to six months’ worth of living expenses. However, you may need to adjust this amount based on factors such as job stability, health considerations, and other personal factors.

Choosing the right savings account is also crucial for your emergency fund. Look for accounts that offer competitive interest rates, easy access to funds, and low or no fees. Consider utilizing high-yield savings accounts or money market accounts, which generally offer higher interest rates compared to traditional savings accounts.

Automating your savings can make it easier to build and maintain your emergency fund. Set up automatic transfers from your paychecks or checking account to your designated emergency savings account. By making saving a routine, you can steadily grow your emergency fund without much effort.

Additionally, adopting money-saving strategies such as cutting unnecessary expenses, negotiating bills, and shopping for the best deals can help you build your emergency fund faster.

Creating a Budget

Creating and sticking to a budget is an integral part of successful financial management. A budget helps you understand your income, track expenses, and make informed financial decisions. By managing your cash flow effectively, you can have more money available for investing.

Start by identifying your income sources and categorizing your expenses. Include fixed expenses like rent or mortgage payments, utilities, and loan payments. Also, consider variable expenses such as groceries, entertainment, and discretionary spending.

Tracking and categorizing your expenses allows you to identify areas where you can cut back and save more money for investing. It also helps you set realistic spending limits and prioritize your financial goals. There are various budgeting tools and apps available that can help simplify the process and track your progress.

Setting realistic spending limits is crucial for maintaining financial stability while investing. Avoid overspending on non-essential items and focus on allocating a portion of your income towards your investment goals. Building discipline and sticking to your budget will pave the way for long-term financial success.

Paying Off High-Interest Debt

Before fully committing to investing, it’s important to pay off any high-interest debt you may have. High-interest debt, such as credit card debt or payday loans, can significantly impact your financial well-being and hinder your ability to build wealth.

Developing a debt repayment plan is crucial to effectively tackle your outstanding debt. There are two common methods for debt repayment: the debt snowball method and the debt avalanche method.

The debt snowball method involves paying off your smallest debt balance first while maintaining minimum payments on other debts. Once the smallest debt is paid off, you apply the money previously allocated to that debt towards the next smallest balance. This approach provides a psychological boost as you achieve quick wins, helping to build momentum in your debt repayment journey.

The debt avalanche method focuses on paying off debts with the highest interest rates first. By prioritizing high-interest debts, you minimize the overall interest paid over time. While it may take longer to see results compared to the snowball method, the debt avalanche method typically saves you more money in the long run.

Consolidating debt is another strategy to consider if you have multiple debts with high interest rates. Consolidating involves combining multiple debts into a single loan or credit account with a lower interest rate. This can simplify your debt repayment process and potentially save you money on interest.

Lastly, to avoid future debt, it’s important to develop healthy financial habits. An effective strategy is to live within your means, avoid unnecessary borrowing, and prioritize saving before spending. By paying off high-interest debt and adopting responsible financial habits, you’ll be in a stronger position to invest and build wealth.

Determining Your Risk Tolerance

Understanding your risk tolerance is a critical step in developing your investment strategy. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. It mainly depends on factors such as your financial situation, time horizon, and personal preferences.

Assessing your own risk tolerance involves considering various factors. One factor is your investment time horizon. If you have a longer time horizon, you may have a higher risk tolerance since you have more time to recover from market downturns. On the other hand, if you have a shorter time horizon, you may prefer a more conservative investment approach to preserve capital.

Another factor to consider is your financial situation and goals. Determine how much money you are willing to potentially lose without jeopardizing your financial well-being. Additionally, consider your emotional response to market fluctuations. If you have a low tolerance for volatility and are easily stressed by market downturns, a more conservative investment approach may be suitable for you.

Matching your investments to your risk tolerance is crucial for long-term investment success. Conservative investors may prefer low-risk investments such as bonds or index funds, while aggressive investors may be more comfortable with higher-risk options like stocks.

Remember that risk tolerance is not a static factor and may change over time. As your financial situation and goals evolve, it’s important to reassess your risk tolerance periodically and adjust your investment strategy accordingly.

More to read: Earn Passive Income Through Online Investments

Choosing the Right Investment Accounts

Choosing the right investment accounts is crucial for maximizing your investment potential and minimizing costs. There are various types of investment accounts, each with its own advantages and considerations.

Common types of investment accounts include individual retirement accounts (IRAs), employer-sponsored retirement plans like 401(k)s, and taxable brokerage accounts. Additionally, there are specialized accounts like health savings accounts (HSAs) and education savings accounts (ESAs) that offer unique benefits.

When comparing investment accounts, consider factors such as fees and expenses. Some accounts may charge management fees or transaction fees, which can eat into your investment returns. Choose accounts with low fees and expenses to maximize your long-term investment growth.

Tax implications are another critical consideration when selecting investment accounts. IRAs and 401(k)s offer tax advantages, such as tax-deductible contributions or tax-free growth, making them attractive options for retirement savings. However, they come with certain restrictions and penalties for early withdrawals.

Optimizing your investment account selection involves understanding your investment goals, time horizon, and tax situation. Consider consulting with a financial advisor or tax professional to determine the most suitable accounts for your needs.

The Power of Compound Interest

One of the most powerful forces in investing is compound interest. Compound interest is the concept of earning interest on both your initial investment and any accumulated interest. It allows your investment to grow exponentially over time.

The sooner you start investing, the more time your investments have to compound and grow. Even small amounts of money invested consistently over time can lead to significant wealth accumulation due to the power of compound interest.

To maximize the power of compound interest, it’s crucial to start investing early and consistently. By contributing regularly to your investment accounts, you can take advantage of compounding and potentially see exponential growth in the value of your investments.

Diversifying Your Portfolio

Diversification is a crucial strategy to manage risk and optimize returns. It involves spreading your investments across different asset classes, industries, and geographic regions. Diversification helps reduce the impact of any single investment’s performance on your overall portfolio.

By diversifying your portfolio, you can mitigate the risk of significant losses in case one investment performs poorly. Different asset classes, such as stocks, bonds, and real estate, have varying levels of risk and return potential. Investing in a mix of asset classes can help you achieve a balance between growth and stability.

Within each asset class, consider diversifying further. For example, within the stock market, you can invest in various industries, sizes of companies, and international markets. This further spreads your risk and increases the potential for positive returns.

Research shows that a well-diversified portfolio enhances long-term performance and reduces volatility. It’s important to regularly review and rebalance your portfolio to maintain diversification as market conditions and your investment goals change.

Investing in Stocks

Investing in stocks allows you to become a partial owner of a company and participate in its growth. Stocks represent shares of ownership in publicly-traded companies and can provide the potential for significant returns. However, investing in individual stocks requires careful research and analysis.

When investing in stocks, it’s important to consider factors such as the company’s financial health, industry trends, and management team. Conduct thorough research and analyze the company’s financial statements, growth prospects, and competitive advantages before making any investment decisions.

It’s also important to be aware of the risks associated with stock investing. Stock prices can fluctuate significantly in response to economic conditions, industry trends, and company-specific factors. Understanding these risks and mitigating them through diversification and thorough research is crucial to successful stock investing.

Investing in Bonds

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When you invest in bonds, you lend money to the issuer in exchange for periodic interest payments and the return of your principal at maturity. Bonds are generally considered lower-risk investments compared to stocks.

Bonds offer fixed income and can provide stability and regular cash flow in an investment portfolio. They are often used as a way to preserve capital and generate income. However, investing in bonds also comes with risks, such as interest rate changes and credit risk.

Before investing in bonds, consider factors such as the creditworthiness of the issuer, interest rate environment, and maturity dates. Government bonds are generally considered less risky than corporate bonds, although they may offer lower yields.

Diversifying your bond investments across different issuers, bond types, and maturities can help mitigate risks. Fixed income investments should be aligned with your risk tolerance and investment goals.

Investing in Real Estate

Investing in real estate can provide both income and potential appreciation. Real estate investments include residential properties, commercial properties, and real estate investment trusts (REITs).

Investing in rental properties can generate regular income through rental payments. However, it requires careful considerations such as property selection, management, and maintenance costs. Real estate investing can also involve significant upfront costs and financial obligations.

Alternatively, real estate investment trusts (REITs) offer a way to invest in real estate without directly owning properties. REITs are companies that own, operate, or finance income-generating real estate properties. By investing in REITs, you can gain exposure to the real estate market and potentially receive dividends.

Before investing in real estate, it’s important to assess your financial situation, risk tolerance, and investment time horizon. Real estate investing requires careful planning, market research, and considerations of factors such as location, rental market trends, and financing options.

Investing in Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the investors.

Investing in mutual funds offers diversification and professional management, making it suitable for beginners. There are different types of mutual funds, ranging from index funds that aim to replicate the performance of a specific market index to actively managed funds that seek to outperform the market.

Before investing in mutual funds, consider factors such as the fund’s investment strategy, historical performance, fees, and expenses. Mutual funds charge management fees, known as expense ratios, which can significantly impact your returns over time. Look for funds with low expense ratios and strong track records of consistent performance.

Mutual funds offer accessibility and convenience, allowing you to invest in a diversified portfolio with a relatively small initial investment. They are regulated investment vehicles, providing transparency and investor protections.

Investing in Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are similar to mutual funds in that they pool investors’ money to invest in a diversified portfolio. However, ETFs trade on stock exchanges like individual stocks, allowing investors to buy and sell shares throughout the trading day at market-determined prices.

Investing in ETFs offers flexibility, liquidity, and diversification. ETFs often have lower expense ratios compared to mutual funds, making them cost-effective investment options. They also provide exposure to specific sectors, industries, or markets, allowing investors to fine-tune their investment strategy.

When investing in ETFs, consider factors such as the ETF’s expense ratio, liquidity, tracking error, and underlying assets. Look for ETFs that closely track their respective indexes and have low expense ratios. Additionally, ensure the ETF has sufficient trading volume to ensure liquidity and avoid bid-ask spreads.

ETFs offer access to a wide range of asset classes and investment styles, making them suitable for various investment goals and risk tolerances.

Investing in Index Funds

Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index, such as the S&P 500. Index funds offer diversification and low expense ratios, making them popular investment options for beginners.

Investing in index funds allows you to gain exposure to broad market performance rather than trying to beat the market. By investing in the entire index, you are essentially investing in a diverse range of companies, spreading your risk and reducing the impact of individual stock performance.

Index funds are passively managed, meaning they aim to match the performance of the underlying index rather than actively selecting stocks. This results in lower management fees compared to actively managed funds, making index funds cost-effective investment options.

When investing in index funds, consider factors such as the fund’s tracking error, expense ratio, and diversification. Look for funds that closely track their respective indexes and have low expense ratios. Additionally, ensure the fund’s underlying index aligns with your investment goals and risk tolerance.

Investing in Retirement Accounts

Investing in retirement accounts is crucial for long-term financial planning. Retirement accounts, such as individual retirement accounts (IRAs) and employer-sponsored retirement plans like 401(k)s, offer tax advantages and help individuals save for retirement.

Contributions to retirement accounts are often tax-deductible or eligible for tax deferral, meaning you can potentially lower your tax liability. Additionally, investment earnings within these accounts grow tax-free, allowing for greater long-term accumulation.

When investing in retirement accounts, it’s important to consider factors such as your contribution limits, employer matching contributions, and investment options. Take advantage of employer matching contributions if available, as they provide free money towards your retirement savings.

Investing in retirement accounts should be aligned with your long-term financial goals and risk tolerance. Balancing your investment portfolio across different asset classes and regularly reviewing your investment strategy is crucial for optimizing your retirement savings.

Investing in Education

Investing in education is an investment in yourself or your loved ones’ future. Education is a powerful tool that can increase earning potential and open doors to new opportunities.

When investing in education, consider factors such as the cost of tuition, potential return on investment, and available funding options. Research the job market and industry trends to assess the potential financial benefits of your chosen educational path.

Funding options for education include scholarships, grants, student loans, and education savings accounts. It’s important to weigh the costs and benefits of financing options and choose the most suitable strategy for your circumstances.

Investing in education should be aligned with your overall financial goals and objectives. Consider the long-term impact of educational investments on your financial well-being and weigh the potential return on investment against the associated costs.

Long-Term vs. Short-Term Investments

When investing, it’s important to consider your time horizon and investment goals. Investments can be classified as either long-term or short-term, depending on the anticipated holding period.

Long-term investments are typically held for more than five years and are focused on achieving growth and wealth accumulation over time. Examples of long-term investments include retirement accounts, stocks, and real estate. Long-term investments allow for potential compounding and the ability to ride out market fluctuations.

Short-term investments, on the other hand, are held for one to five years and are often focused on preserving capital and generating income. Examples of short-term investments include high-yield savings accounts, certificates of deposit (CDs), and short-term bond funds. Short-term investments provide liquidity and stability but may offer lower returns compared to long-term investments.

Determining the appropriate mix of long-term and short-term investments depends on factors such as your financial goals, risk tolerance, and time horizon. It’s important to strike a balance between growth and stability to effectively achieve your investment objectives.

Tax Considerations for Investors

Tax considerations play a significant role in investing and can impact your overall investment returns. Having a basic understanding of tax rules and strategies can help you optimize your after-tax investment growth.

Different types of investments have varying tax implications. For example, investments held in retirement accounts like IRAs or 401(k)s offer tax advantages such as tax-deductible contributions or tax-free growth. On the other hand, investments held in taxable brokerage accounts are subject to capital gains taxes.

Additionally, the timing of your investment transactions can also impact your tax liability. Gains realized from investments held for less than one year are generally taxed at a higher rate than investments held for more than one year.

Tax-loss harvesting is a strategy that involves offsetting capital gains with capital losses to reduce your tax liability. By strategically selling investments that have declined in value, you can generate losses that can be used to offset taxable gains.

Utilizing tax-efficient investment vehicles, such as index funds or ETFs, can help minimize taxes due to their low turnover and reduced capital gains distributions.

Consulting with a tax professional or financial advisor can help you navigate the complexities of tax considerations and develop strategies to minimize your tax burden while maximizing your investment returns.

Monitoring and Adjusting Your Portfolio

Once you have established your investment strategy, it’s crucial to regularly monitor and adjust your portfolio. Market conditions, economic factors, and personal circumstances can change over time, requiring periodic reassessment of your investment holdings.

Regularly review your portfolio to ensure it remains aligned with your investment goals and risk tolerance. Rebalance your portfolio if necessary, meaning adjust the allocation of your investments to maintain the desired asset allocation. Market fluctuations can cause your portfolio to deviate from your intended asset allocation, potentially increasing risk or reducing returns.

When adjusting your portfolio, consider factors such as your investment time horizon, financial goals, and market conditions. Rebalancing involves selling securities that have performed well and buying more of those that have underperformed. This “buy low, sell high” approach helps manage risk and maintain a disciplined investment strategy.

It’s also important to review your portfolio’s performance against your financial goals. Are you on track to meet your objectives? Consider making adjustments to your investment strategy if necessary to stay on course.

Seeking Professional Advice

While investing can be done independently, seeking professional advice can provide valuable insights and guidance. Financial advisors can help you develop a personalized investment strategy, assess your risk tolerance, and navigate complex investment decisions.

Knowing when to seek professional advice depends on your individual circumstances and comfort level. If you are new to investing or grappling with complex financial situations, hiring a financial advisor can provide peace of mind and help you make informed decisions.

When choosing a financial advisor, consider factors such as their qualifications, experience, and area of expertise. Look for certifications such as Certified Financial Planner (CFP) to ensure a certain level of competence and ethical standards.

Regularly reviewing and communicating with your financial advisor is essential for maintaining a strong partnership. Update your advisor on any changes in your financial situation or goals and seek their advice on adjusting your investment strategy accordingly.

Remember that ultimately, you are in control of your financial future. While seeking professional advice can be helpful, it’s important to educate yourself about investing and actively participate in your investment decisions.

Conclusion

Investing is a powerful tool for building wealth and achieving your financial goals. By understanding the basics of investing, setting clear financial goals, and adopting sound investment strategies, you can start your investment journey with confidence. Continuously educate yourself, monitor your investments, and seek professional advice when needed. With patience, discipline, and a long-term perspective, you can unlock the potential of investing and build a secure financial future.